Consumption tax is the category of indirect tax which is applied on the consumption of goods and services. Following is the partial list of taxes which are categorized as a consumption tax.

- Good and Services Tax (GST)

- Value Added Tax (VAT)

- Harmonized Sales Tax (HST)

For managing consumption tax, companies need to separately maintain tax paid to the supplier and received from customers. The difference of balances of these accounts helps companies in determining the tax amount payable to the government authorities.

Let's consider a scenario to understand how consumption taxes are managed in ERPNext.

Gadget Technologies Pvt. Ltd. is a company based in India. They are into trading of computer peripherals. Products they deal in has 18% GST applied on it.

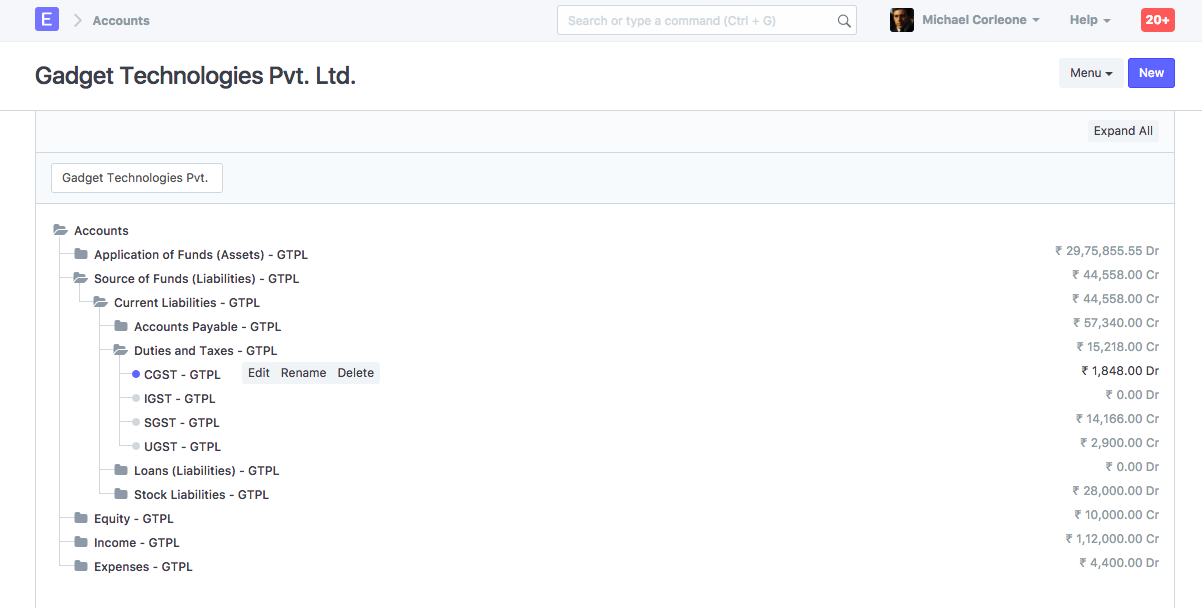

Setting up GST Accounts

Create a GST tax accounts based in the GST rate applicable on your items. Following is an example of how you can setup GST tax account can be created for the Company in your ERPNext account.

Also, you can consider creating separate GST accounts for tracking input GST (received from the Customer) and output GST (paid to Suppliers). The difference in both these accounts is what would be the amount payable to the government authorities.

Sales and Purchase Tax Masters

Create a Sales Taxes and Purchase Tax master based on the GST applied. For example, in india, the GST account applicable on a sales/purchase transaction differs based on your location and customer's location. Hence, you can create two separate sales and purchase tax masters, In State and Out State.

Posting in Tax Ledgers

Posting in tax ledger will happen on the submission of Sales Invoice and Purchase Invoice.

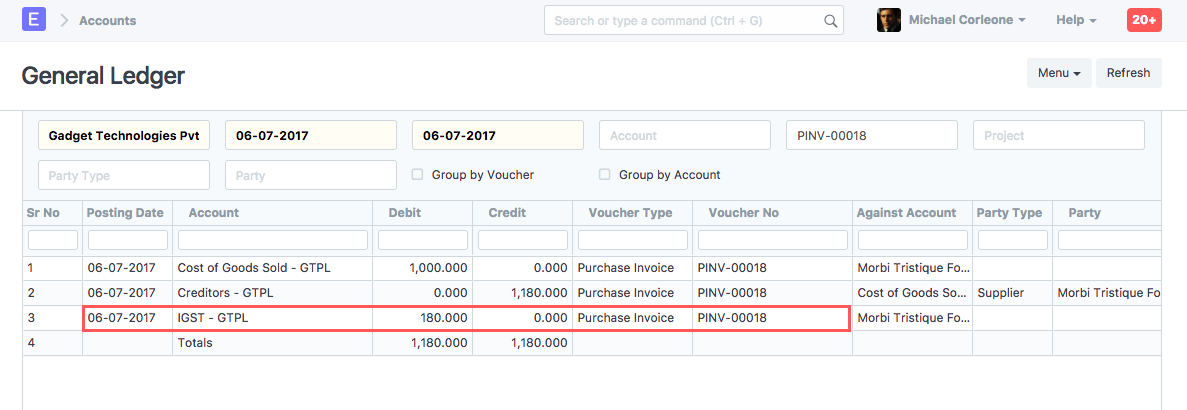

Purchase Invoice

Let's assume we made purchases of some computer peripherals on which tax is applied. If purchases were made of goods worth 1000, and 18% GST is applied on them, total tax amount would be 180.

Sales Invoice

If we sell an above-purchased item for 1500, with GST 18% applied, following would the general ledger for that Sales Invoice.

Paying Tax to the Government

The balance in each GST account will be composed on posting based on sales and purchase transaction. Considering our example, the GST payable will be 90.ased on the periodicity of tax payment, you should post Journal Voucher. Select all the GST account and Bank Account from which tax payment is being made.

| Tax | Balance | Notes | | GST 18% | 270 | Tax received from Customers | | GST 18% | 180 | Tax already paid to Suppliers | | Tax Payable | 90 | Tax payable to government |

Based on the periodicity of tax payment, you should post Journal Voucher. Select all the GST account and Bank Account from which tax payment is being made.

The help video linked here covers how you can use generate GST complaint invoices and reports in ERPNext, as per the Indian GST tax regime.

Mohammad Umair Sayed

Umair is one of the co-founders of Frappe and VP - Partnerships. He has lead support in the early days and driven implementation cadence.

No comments yet. Login to start a new discussion Start a new discussion